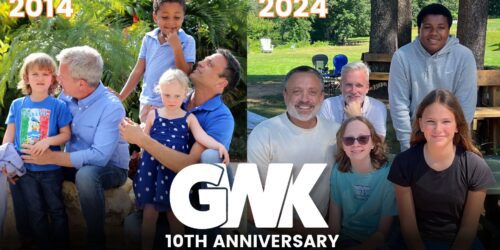

“We’re still a new family of 4, and exhausted every minute of the day, but wouldn’t change a thing!” — 5 Gay Dad Families Share Their Journies

We are constantly showcasing incredible gay dad families over on Instagram. Here is a quick roundup of some of our